The global energy industry has experienced tremendous changes in the past 10 years, with new Independent Power Producers (IPPs) becoming critical to support the world's increasing need for electricity. Despite the increasing importance of IPPs, challenges faced by independent power producers are equally confronted with threats to their operational efficiencies, financial sustainability, and ultimately their future. Many of these IPP challenges in the power sector are amplified and complicated by developmental changes in power markets, rapid onc-regulatory changes, and increasing competition.

Understanding these challenges in energy is important for all stakeholders in the energy value chain, from investors and policymakers to technology vendors and grid operators. In this analysis, we produced a holistic reference system that defines the multifaceted challenges faced by independent power producers in today's changing energy landscape, and described the implications for the competitive and financial performance of the broader power sector, while identifying potential risk mitigation practices.

Independent power producers (IPPs) are private companies that produce electricity. Companies, government entities, and large commercial customers buy electricity from IPPs. Regular utility company/ies produce electricity and send it to customers over wires. In contrast, IPPs produce electricity only and usually specialize in a technology and/or market segment. The relatively narrow focus allows IPPs to offer innovation, reliability, efficiency, and more competitive pricing in the marketplace.

Independent power producers are seeing growth partly from market liberalization, additional demand for new generation capacity, and the push for cleaner energy. Growth could be limited by independent power producer market risks that continue to change with a rapidly fluctuating market.

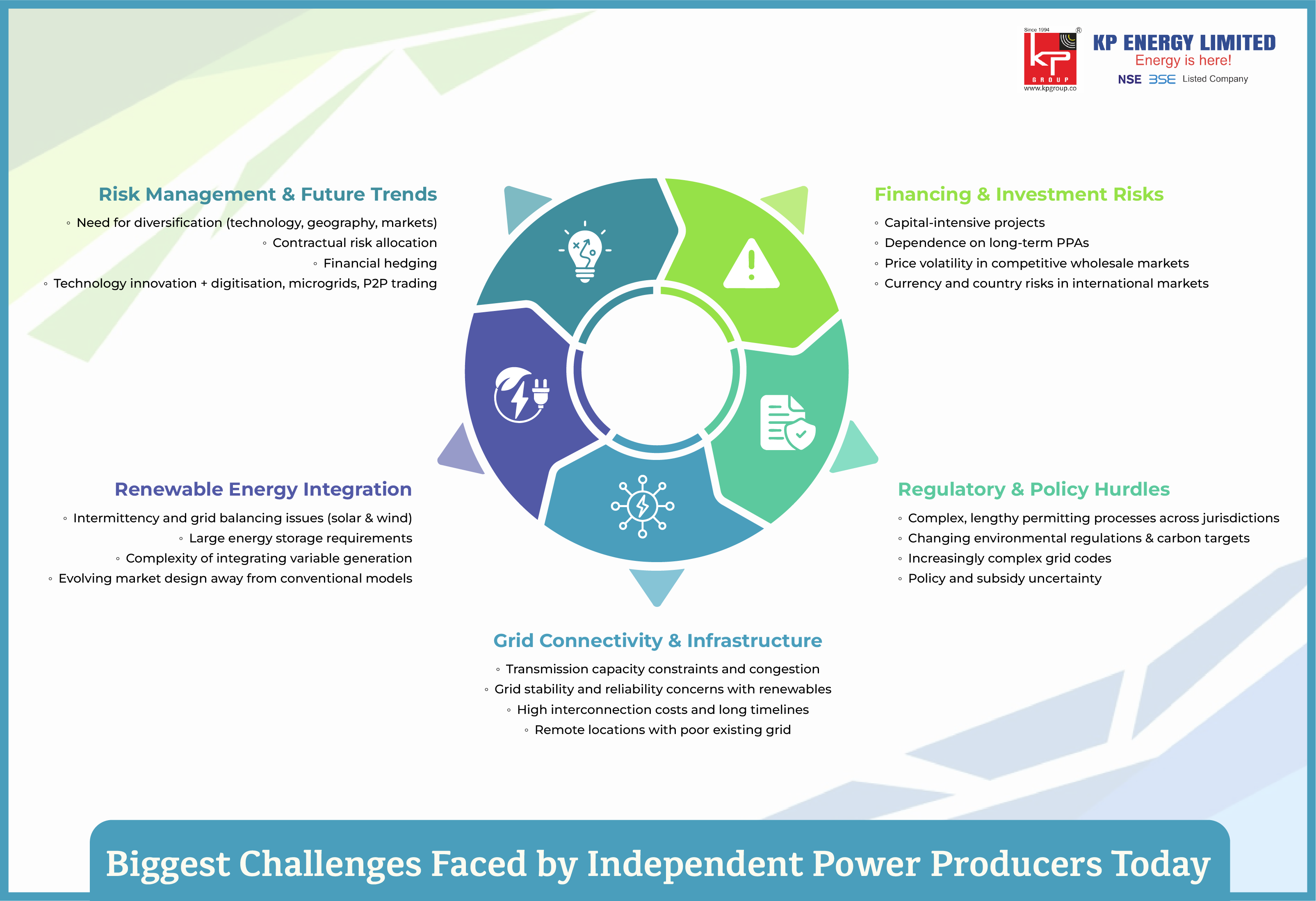

One of the most significant challenges faced by independent power producers revolves around securing adequate financing and managing investment risks. Utility companies have multiple revenue streams and are typically heavily regulated.

Power generation projects require upfront capital investments that may be millions or billions of dollars, depending on both the technology and the scale. Independent Power Producers (IPPs) must compete for infrequent capital and must convince potential investors and lenders that they will be in the game for the long haul.

Most IPPs are highly dependent on securing long-term Power Purchase Agreements (PPAs) for a revenue stream and to facilitate financing. Risk management in independent power production becomes most important when negotiating contract terms that balance revenue certainty against operational flexibility.

Independent power producers are exposed to electricity price volatility while operating in competitive wholesale market contexts. The result of such market price dynamics is cash flows that are highly variable, and the ability to secure progressive financing terms is more difficult over the longer-term horizon.

IPP's operating in international markets face additional risks in the shape of currency movements and country-specific risks.

What Regulatory and Policy Hurdles Limit IPP Growth?

Regulatory hurdles for IPPs are some of the toughest barriers in the power sector. These barriers can dramatically lengthen project development processes, increase project operating costs, and influence the level of competitiveness in the marketplace.

In order to complete power projects, IPPs must acquire permits and licenses from several regulatory agencies that may be duplicative and different from jurisdiction to jurisdiction. The permitting process can also be lengthy, expensive, and unpredictable, with the rules about what is required changing significantly based on project type and region.

As governments globally continue to mandate increasingly strict environmental standards and carbon reduction targets, IPPs have to be flexible with their operations and methodologies based investment strategies.

IPPs must comply with increasingly complex grid codes that govern how power plants connect to and operate within the electrical grid.

Frequent changes in energy policies, subsidy regimes, and regulatory frameworks create uncertainty that can deter investment and complicate long-term planning.

Grid connectivity is a key challenge for IPPs, because power customers will need access to the transmission infrastructure in order to receive power. There are often obstacles related to all things "infrastructure" that can significantly affect the feasibility and operations of a project.

Many areas face transmission capacity limits that will restrict whether new generation sources can connect to the grid. Therefore, in some regions, even when IPPs build new generation facilities, at times they may be unable to deliver their full output to market due to grid congestion, which results in curtailment and lost opportunities for revenue. IPPs cannot build new transmission infrastructure, nor can they most afford it.

The use of renewable energy generation is increasing in the power generation space, leading to potential new grid operator challenges related to system stability and reliability. Independent power producers (IPPs) with renewable energy facilities will need to develop, operate, and maintain sophisticated forecasting, energy storage, and grid-balancing market services to address these challenges.

Whenever new power plants interconnect to the electrical grid, there is typically even more significant amounts of investment in substation infrastructure (or upgrade), transmission lines, and protection equipment. The interconnection costs can be a substantial part of total project costs and the process of getting approvals and constructing can take many years within a project development timeline.

Numerous IPPs are in the process of connecting a renewable energy project when they probably have to specify it in an area that possesses plenty of available resources but hardly any existing grid. Connecting remote sites with transmission facilities to the grid comes with high costs and difficult environmental and permitting challenges.

The global transition toward renewable energy sources has created unique challenges for IPPs operating in this sector. Renewable energy integration challenges have become increasingly complex as the share of variable generation sources continues to grow.

It is challenging to balance the grid and be reliable when renewable resources (solar and wind) have a variable and intermittent nature, as mentioned above. Independent power producers (IPPs) will have to invest in forecasting ability, energy storage systems, and/or grid services for the variability issues and remain competitive in the market.

As renewable energy sources account for a larger share of the energy supply mix, energy storage systems become increasingly important. Independent power producers need to think about whether or not to invest in storage technologies that will add dispatchability to their renewable plants. The problem is that investment decisions can be difficult due to a substantial amount of capital required and uncertainty related to both the technology and economics of such technologies.

Connecting substantial amounts of renewable energy to existing electricity networks requires advanced control systems and coordinators. Independent Power Producers (IPPs) need to partner with grid operators to ensure their facilities are operating within the electricity system safely and reliably.

Conventional electricity market designs were established around conventional power plants that produced electricity in predictable patterns. With the growing penetration of renewable energy, market structures and pricing mechanisms have changed to accommodate variable generation. Independent Power Producers (IPPs) must also adapt and find new sources of revenue from the newly defined market rules.

To effectively manage risks as an independent power producer requires an end-to-end approach to the management of financial risks, operational, compliance, and market risks. Most successful IPPs will utilize a combination of the strategies to mitigate their varying risks.

Portfolio diversification in different technologies, geography, and market segments can help mitigate the overall risk exposure. IPPs may operate a combination of renewable and conventional facilities, enter into several electricity markets and operate in different regulatory jurisdictions.

Well-structured contracts with suppliers, customers, and service providers will allocate risks to those who can manage them best. Some focus can be placed on terms negotiated for fuel supply agreements, maintenance contracts, and power purchase agreements, for example.

Many Independent Power Producers (IPPs) use a variety of financial instruments to mitigate risk in commodity price volatility, currency risk, and interest rates.

Identifying areas of performance improvement is important. In part, this is a continuous process of operational improvements, technology, or emerging technologies to address market changes. It is more about thinking in the moment, however, assessing the possible uses of emerging technology.

The environment continues to shift for Independent Power Producers as technologies, market frameworks, and regulatory considerations are evolving. Understanding the trends can be important to enable IPPs to pursue those challenges in the future and take advantage of new opportunities.

The digitization of the power sector creates opportunities for IPPs to better manage and optimize their operations, enter new markets, and offer additional grid services.

The increased distributed generation and recent growth of peer-to-peer trading platforms and microgrids generate a new wave of competition within the power sector. IPPs need to consider the implications of these developments on their conventional business models and the opportunity to become involved in decentralized energy trading.

Q1: What Are the Primary Financial Challenges Facing IPPs Today?

There are many financial dilemmas that IPPs encounter, including project financing, commodity price fluctuations, Power Purchase Agreement negotiations, and currency and country risks when operating in international markets. Aside from these financial problems, IPPs are also faced with the capital-intensive aspect of power generation and face competition for investment capital.

Q2: How Do Regulatory Changes Affect Operations of Independent Power Producers?

Regulatory modifications can significantly impact the operation of independent power producers (IPPs) by changing environmental constraints, grid codes, permitting processes or regulatory structures. As a result of one or more of the changes, there could be regulatory compliance capital investment changes, there may be adjustments to the timing of the project development cycle, and there may be uncertainty related to strategic planning and investment decisions.

Q3: What Strategies Can IPPs Use to Manage Market Volatility?

Independent Power Producers can minimize market volatility around multiple strategies, which include having a diverse portfolio made up of a variety of technologies and geographies, managing both commodity and financial risks with diverse hedging strategies, ideally finding long-term Power Purchase Agreements (PPAs), and making sure they are using technology that allows them to be responsive to the market.

Q4: How Do Grid Integration Challenges Affect Renewable Energy IPPs?

Renewable IPPs face challenges that are not faced to the same extent by other power producers in terms of grid connectivity, as there are unique issues associated with intermittent and variable generation, sunk capital in storage that may not be needed for three years or more, evolving grid codes that add uncertainty, and changes to market design that require accommodating variable generation. The grid is definitely an issue for IPPs (e.g., investment in interconnection transmission), but often the connection challenges necessitate additional capital investment for grid interconnections beyond the base generation facility.

Q5: What Role Does Technology Play in Addressing IPP Challenges?

Technology will help to address challenges faced by IPPs in a range of ways: better operational efficiencies, improved forecasting and connection to the grid, the creation of more revenue streams from grid services, and help with risk management through control and monitoring systems.