India is on a slow, and steady path to energy independence that is becoming essential for economic growth and industrial development. With rising demand for energy and increasing pressure to reduce reliance on foreign sources, India must find a way of planning through these growing challenges by considering a suite of solutions for delivering price competitive, reliable, and sustainable energy supply.

One of the most significant contributors to this transition is the adoption of Captive Power Plants (CPPs). These plants allow industries to generate their own electricity, rather than relying solely on the central grid. Captive power plants are no longer a fad but a practical and sustainable approach for organization to rationalize performance, cost, and sustainability. If you are interested in identifying budget-friendly captive power solutions, this guide will demystify it all.

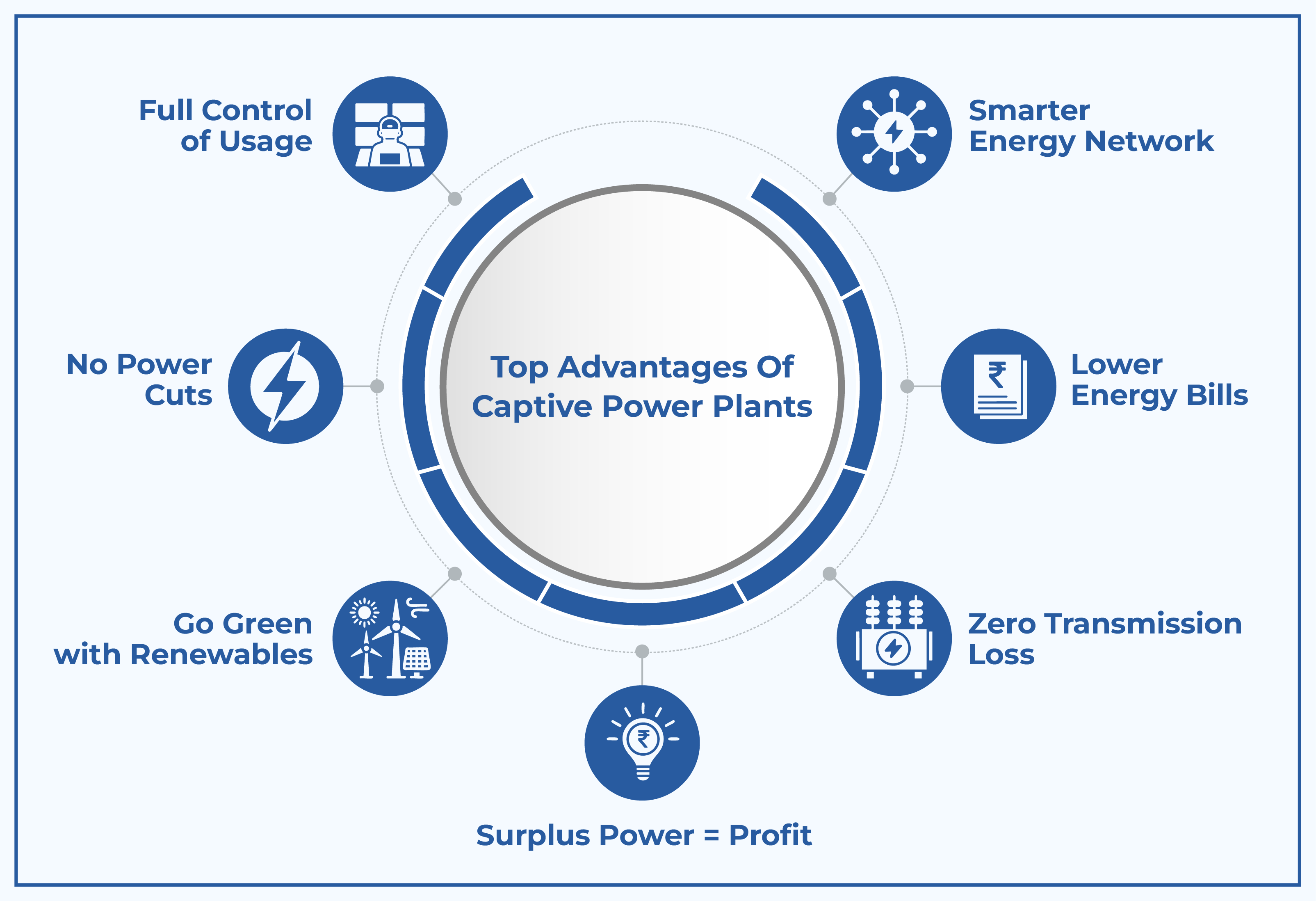

One of the biggest reasons businesses go for CPPs is cost savings. With electricity tariffs rising, generating your own power makes financial sense. Over time, the captive power plant cost easily pays for itself.

If your business can't afford downtime, CPPs give you energy security. No more halts in production due to grid failures or supply shortages.

Having your own industrial captive energy setup means no surprises when it comes to energy expenses. You decide how much power you need and when to use it.

If your plant generates more than you need, that extra energy can be sold to the grid, adding another revenue stream to your business.

The power is generated at the location where it’s used so you will not have losses on long distances of transmission.

CPP’s powered by solar, wind, or hybrids, help you to achieve Renewable Purchase Obligations (RPOs), which in turn will lower your carbon footprint.

CPPs also contribute to a more distributed power network, reducing the load on public infrastructure and increasing national energy efficiency.

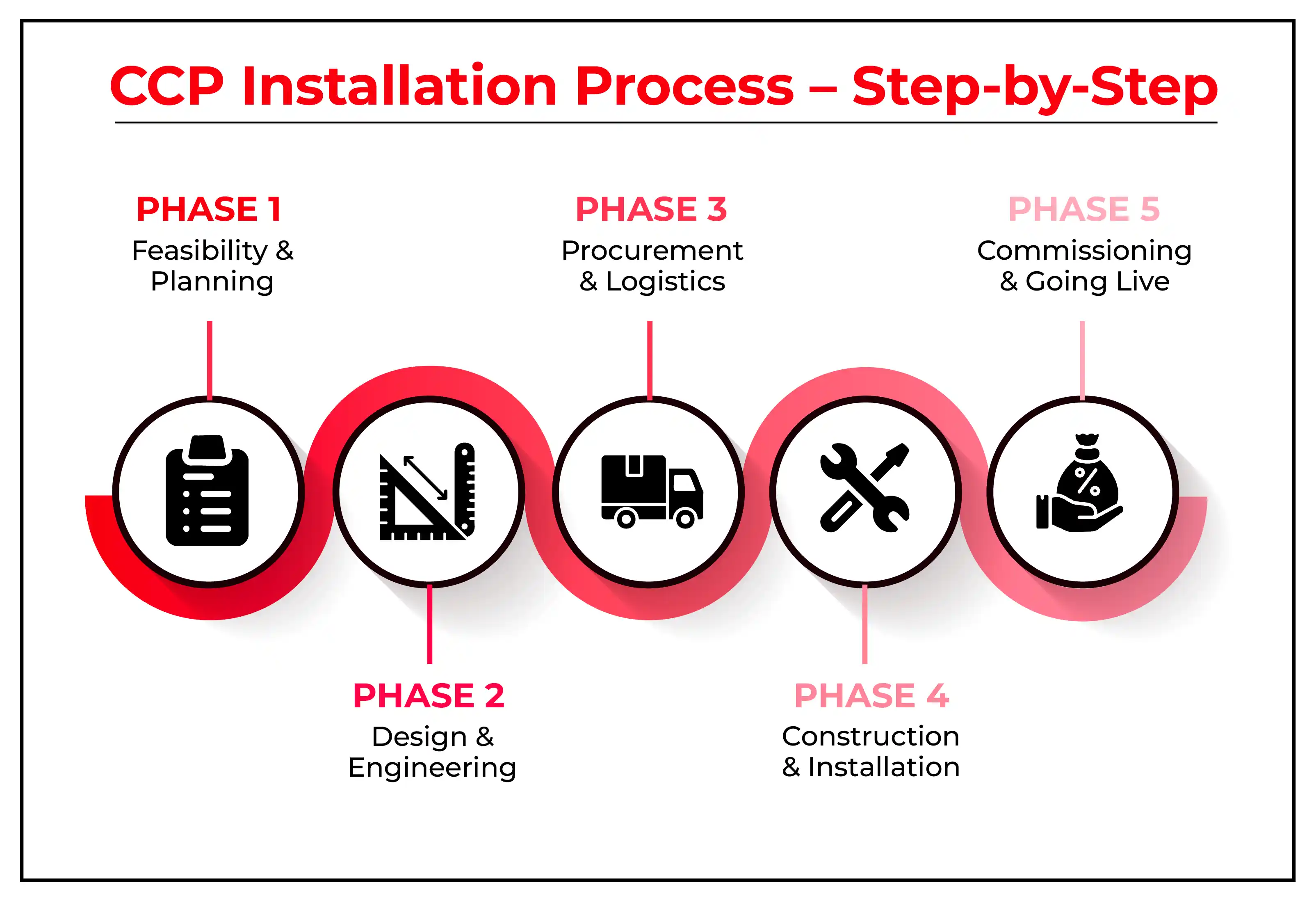

Thinking about how to install a captive power plant and what are the advantages of captive power plant? Here’s a simple breakdown of the process, from planning to powering up.

Understand Your Energy Needs

What’s your daily power requirement? What kind of load do you use? This is where it all begins.

Estimate your captive power plant setup cost in India. A good feasibility report will also help you calculate when you'll break even.

Each state has its own norms. You’ll need permits and approvals depending on your plant type and capacity.

Solar? Wind? Gas? Or a mix? Pick what suits your business and your location best. There are many types of captive power generation available now.

This includes layout plans, equipment sizing, battery storage (if needed), and power backup planning.

After everything the set up is designed, the engineering team gets to work on safety and efficiency.

From turbines to panels, choose suppliers that are reliable and certified

Get everything to your site on time to avoid construction delays.

Level the ground, install foundations, and get basic civil works in place.

Install equipment, set up wiring, safety controls, and monitoring systems.

If you’re planning to sell or import power, this step is crucial.

Run trials, check outputs, and fix any issues.

Make sure your staff knows how to operate and maintain the plant.

And just like that, you’ve got self-power generation for your factory.

Worried about costs? Here’s how to stay in control of your investment:

Commence by implementing a partial load coverage model; then, when business grows, or savings accrue, add capacity.

Select technology that fits your energy profile and we are not going to be over-delivered, as running oversized technology can eat into your budget.

Take full advantage of any subsidies, soft loans, and government supported low-cost captive energy systems for renewable installations in particular.

Group captive models allow you to partner with other businesses ,meaning the investment and long-term costs are shared.

Good engineering and efficient components can significantly reduce your operating expenses down the line.

Companies like KP Energy offer end-to-end services, from design to installation, so you stay on budget and on schedule.

Solar and wind require higher upfront costs, while gas-based CPPs are cheaper to install but can cost more to run.

Maintenance, fuel (if applicable), and repairs all add up, but renewables often have very low ongoing costs.

Most CPPs recover their investment within 4–7 years. After that, it’s all savings.

Over a 10–20 year lifecycle, CPPs not only pay for themselves, they also add long-term value to your assets.

These are high in some states, and they eat into your savings if you're selling or buying power from the grid.

Getting permissions, especially for long-term open access, can be time-consuming.

Some states restrict how you store or use your surplus power. This can impact profitability.

Start your renewable energy journey with KP Energy Ltd. – delivering affordable and sustainable captive power plants across India.

KP Energy, located in Gujarat, has been leading the way in renewable CPPs and allows you to utilise the many benefits of captive energy for industries. They provide end-to-end solutions for solar, wind or hybrid captive power plant installation and help industries take control of their energy consumption without costing a fortune.

They’ve already helped several factories in Gujarat and beyond install budget-friendly captive power solutions with:

Turnkey project management

Solid after-sales support

A strong track record in budget-friendly captive energy systems

If you're serious about reducing your energy bills, improving reliability, and going green and pollution free, KP Energy is worth a call.

Q1. How is a captive power plant different from a regular one?

A captive power plant is set up by a company to meet its own energy needs, not for public supply. It’s designed specifically for tailored efficiency.

Q2. What are the biggest benefits for industries?

A. Lower costs, stable supply, more control, and a chance to earn from extra power.

Q3. Who uses CPPs the most?

A. Industries like textiles, cement, steel, chemicals, and engineering, anyone with a steady and significant energy demand.